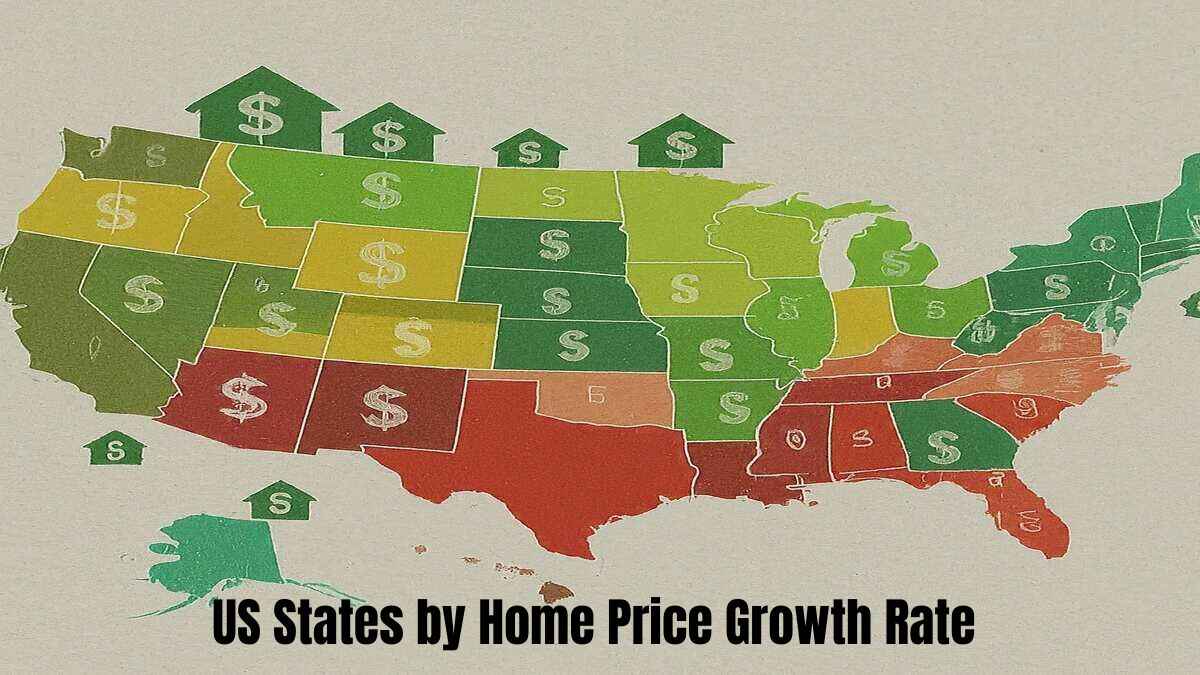

The U.S. housing market is experiencing significant growth in 2024, with home prices soaring in nearly every state. As of the first quarter of 2024, home prices rose sharply by 6.6% year-over-year, the largest increase since 2022. This significant increase is driven by a number of factors, including a severe shortage of homes for sale and a general reluctance among homeowners to sell their properties, all of which is happening against a backdrop of persistently high interest rates.

- Optical Illusion Challenge: If you have Eagle Eyes Find the number 28 among 20 in 6 Seconds?

- Optical Illusion For Brain Test: Dont Get Mesmerized By The Beauty Of The Image. Locate The Parrot In It

- Optical Illusion to Test Your Vision: Can you find the Hidden Blue Berry in 10 Seconds?

- Observation Skill Test: If you have Keen Eyes Find the Word Food among Foot in 15 Secs

- Optical Illusion: Can You Locate The Squirrel In This Mansion Image Within 14 Seconds?

Also read | List of US states by area

You are watching: List of US States by Home Price Growth Rate 2024

Home price growth by state in 2024

National home price increases between the first quarter of 2023 and the first quarter of 2024 were seen in all 50 states. The five states with the highest annual growth rates were Vermont at 12.8%, followed by New Jersey at 11.6%, New York at 10.9%, Delaware at 10.7%, and Wisconsin at 9.9%. Here is the full list:

|

rank |

state |

1 year |

Quarter |

5 years |

Since the first quarter of 1991 |

|

1 |

Vermont (VT) |

12.80% |

3.33% |

73.31% |

314.91% |

|

2 |

New Jersey (NJ) |

11.58% |

2.20% |

66.50% |

293.50% |

|

3 |

New York |

10.87% |

2.08% |

59.24% |

286.76% |

|

4 |

Delaware (DE) |

10.73% |

3.19% |

65.61% |

229.47% |

|

5 |

Wisconsin (WI) |

9.94% |

2.46% |

62.84% |

327.81% |

|

6 |

Kansas (KS) |

9.91% |

2.57% |

58.27% |

289.37% |

|

7 |

Connecticut (CT) |

9.64% |

0.77% |

62.87% |

179.88% |

|

8 |

Illinois (IL) |

9.38% |

2.05% |

47.96% |

196.09% |

|

9 |

New Hampshire (NH) |

9.37% |

1.81% |

74.75% |

342.54% |

|

10 |

Maine (ME) |

9.12% |

3.56% |

81.58% |

364.18% |

|

11 |

Massachusetts (MA) |

8.85% |

1.53% |

55.36% |

348.31% |

|

12 |

South Carolina (SC) |

8.47% |

1.59% |

73.78% |

327.30% |

|

Thirteen |

Rhode Island (RI) |

8.47% |

0.86% |

69.27% |

296.14% |

|

14 |

Nevada (NV) |

8.08% |

2.47% |

53.67% |

310.51% |

|

15 |

Indiana (IN) |

8.04% |

1.31% |

62.20% |

245.89% |

|

16 |

Ohio (OH) |

8.03% |

1.00% |

60.99% |

225.27% |

|

17 |

Pennsylvania (PA) |

7.92% |

1.84% |

52.88% |

247.38% |

|

18 |

Michigan (MI) |

7.79% |

0.42% |

56.88% |

258.17% |

|

19 |

Hawaii (HI) |

7.77% |

6.00% |

55.14% |

297.42% |

|

20 |

Missouri (MO) |

7.60% |

1.51% |

60.22% |

281.46% |

|

twenty one |

Georgia (GA) |

7.27% |

1.21% |

71.81% |

313.84% |

|

twenty two |

Nebraska (NE) |

7.14% |

2.90% |

56.38% |

315.45% |

|

twenty three |

New Mexico (NM) |

7.04% |

3.25% |

61.16% |

295.49% |

|

twenty four |

Maryland (MD) |

6.95% |

1.30% |

44.63% |

255.61% |

|

twenty five |

California (CA) |

6.28% |

0.78% |

50.04% |

321.04% |

|

Twenty-six |

Florida (FL) |

6.13% |

0.54% |

80.65% |

459.42% |

|

Twenty-seven |

Oklahoma (OK) |

6.00% |

1.72% |

53.71% |

272.57% |

|

Twenty-eight |

Tennessee (TN) |

5.95% |

1.18% |

75.14% |

366.70% |

|

Twenty-nine |

Utah (UT) |

5.79% |

1.28% |

68.66% |

606.37% |

|

thirty |

North Carolina (NC) |

5.79% |

0.71% |

74.78% |

324.41% |

|

31 |

Virginia (VA) |

5.73% |

0.32% |

54.52% |

296.29% |

|

Thirty-two |

Kentucky (KY) |

5.60% |

0.95% |

56.13% |

274.10% |

|

33 |

Iowa (IA) |

5.44% |

1.18% |

44.13% |

255.06% |

|

Thirty-four |

Montana (MT) |

5.15% |

1.22% |

78.51% |

601.57% |

|

XXXV |

See more : Observation Skills Test: Can you find the number 177 among 171 in 10 seconds? Arkansas (AR) |

5.15% |

0.85% |

57.94% |

249.88% |

|

Thirty-six |

Washington (WA) |

5.12% |

0.99% |

57.27% |

476.14% |

|

thirty-seven |

Arizona (AZ) |

4.94% |

-1.08% |

74.63% |

461.42% |

|

thirty eight |

Minnesota (MN) |

4.79% |

1.44% |

41.94% |

312.38% |

|

thirty-nine |

Alaska (AK) |

4.66% |

0.74% |

39.22% |

260.58% |

|

40 |

Idaho (ID) |

4.60% |

2.73% |

82.03% |

529.53% |

|

41 |

South Dakota (SD) |

4.27% |

0.91% |

59.18% |

380.42% |

|

Forty-two |

Wyoming (WY) |

4.07% |

1.93% |

51.81% |

417.47% |

|

43 |

Oregon (OR) |

3.96% |

1.62% |

47.73% |

528.46% |

|

Forty-four |

West Virginia (WV) |

3.64% |

-5.73% |

37.80% |

200.46% |

|

forty five |

Colorado (CO) |

3.61% |

-0.04% |

50.55% |

587.41% |

|

Chapter 46 |

Texas (TX) |

3.34% |

0.95% |

54.02% |

345.19% |

|

forty seven |

North Dakota (ND) |

3.30% |

-0.26% |

30.48% |

313.07% |

|

Forty eight |

Alabama (AL) |

3.15% |

0.08% |

57.97% |

251.40% |

|

49 |

Mississippi (MS) |

2.73% |

-4.19% |

46.00% |

203.24% |

|

50 |

Louisiana (LA) |

2.23% |

-0.56% |

28.34% |

257.38% |

|

51 |

District of Columbia (DC) |

-1.53% |

0.84% |

18.89% |

511.21% |

Washington, D.C. was the lone exception, with home prices declining slightly. As of the first quarter of 2024, home prices in the region were down 1.5% year over year. This decline may be attributed to the region’s reputation as one of the most expensive housing markets in the country, causing some potential buyers to take a wait-and-see approach until interest rates become more favorable. Additionally, a significant portion of homes in the region (more than 20% as of January 2024) are listed for more than $1.5 million, which may have contributed to the slowdown.

Also Read | 10 Longest Rivers in North America: Majestic Waterways Bursting with Life

The data comes from the Federal Housing Finance Agency Home Price Index (FHFA HPI), a comprehensive database that allows for comprehensive analysis of home price indices dating back to the 1970s. The index covers all 50 states and more than 400 cities in the United States, and incorporates millions of home sales data, providing valuable insights into home price fluctuations at different levels, including countries, states, metropolitan areas, counties, zip codes, and census areas. FHFA uses a transparent methodology based on weighted repeat sales statistical techniques to examine home price transaction data.

Also read | List of top 50 states in the US for education level

Also read | The 10 least populous states in the US in 2024

Also Read | Top 10 Largest Cities in the United States

Source: https://dinhtienhoang.edu.vn

Category: Optical Illusion