The Union Cabinet has approved the PAN 2.0 project, marking a major enhancement of the existing Permanent Account Number (PAN) system. The initiative aims to improve taxpayer services and facilitate business operations across India.

- Optical Illusion Eye Test: If you have Hawk Eyes Find the Number 85 in 13 Secs

- Optical Illusion Brain Test: If you have Hawk Eyes Find the Odd One Out in this Picture in 12 Secs?

- Who is Poonam Gupta? First Person to Get Married at Rashtrapati Bhavan

- Optical Illusion Challenge: Try To Spot The Stork In This Image In Less Than 15 Seconds

- Optical Illusion Visual Test: If you have Eagle Eyes find the Odd Lotus in 18 Seconds

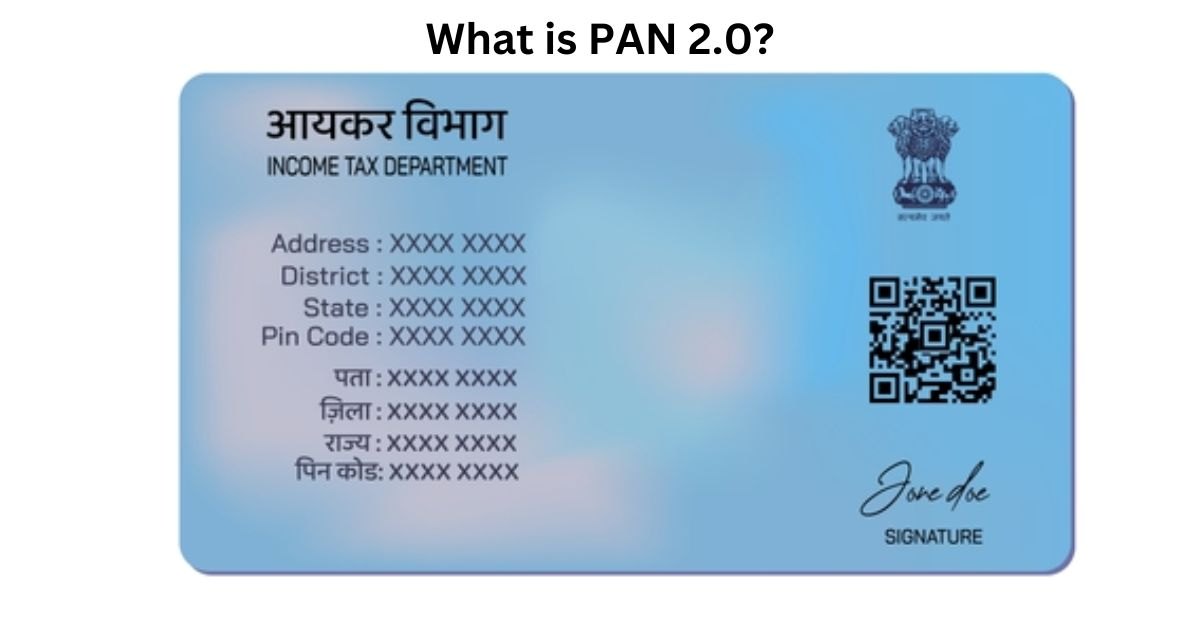

As part of the upgrade, QR code functionality will be integrated into PAN and will be available free of charge to all taxpayers.

You are watching: PAN 2.0: Answers of All Your Doubts for New Pan Card, Key Points by Income Tax Department

In the announcement, Union Minister Ashwini Vaishnaw emphasized that PAN 2.0 will serve as a unified business identifier for all government agencies, thereby simplifying regulatory requirements.

However, concerns have been raised over the status of existing PAN cards that do not have QR codes. As the rollout progresses, we are awaiting clarification on whether such PANs are still valid or need to be updated.

The upgraded systems are designed to increase efficiency and are in line with the government’s wider vision for digital governance and streamlined business processes.

What is PAN 2.0?

A government press release dated November 25, 2024 outlined the PAN 2.0 project as an important e-governance initiative. The project focuses on redesigning the taxpayer registration process through technology-driven advancements in PAN (Permanent Account Number) and TAN (Tax Deduction and Collection Account Number) services. The goal is to provide taxpayers with an enhanced digital experience.

See more : Optical Illusion Brain Test: If you have Eagle Eyes Find the word Cut among But in 15 Secs

PAN 2.0 introduces an upgraded ecosystem that integrates core and ancillary PAN and TAN services, including advanced PAN authentication mechanisms. A key feature of the project is the use of PAN as a universal identifier for designated government digital systems, thereby simplifying interactions between businesses and individuals.

Union Minister Ashwini Vaishnaw highlighted the importance of the initiative, saying: “PAN cards play a vital role in the lives of the middle class and small businesses. With PAN 2.0, we are introducing major upgrades to create a robust digital infrastructure.”

Related stories

Do you need to apply for PAN 2.0 again?

No, current PAN card holders do not need to apply for a new PAN under the upgraded PAN 2.0 system. The existing PAN card will remain valid and functional unless the cardholder chooses to update or correct his or her PAN details.

Under the new system, PAN 2.0’s upgrade functionality will be seamlessly integrated with existing cards without requiring any changes for existing users.

What happens to PAN cards that currently don’t have QR codes?

The inclusion of QR code in PAN cards is not a new feature, it has been implemented since 2017-18. This feature will continue under the PAN 2.0 initiative with enhancements such as dynamic QR codes. The dynamic QR code will display the latest information available in the PAN database.

For PAN holders who have old cards without QR code, there is an option to apply for an updated card with this feature. This can be done under the existing PAN 1.0 system or the new PAN 2.0 framework.

See more : Optical Illusion: Can You Read The Hidden Words In This Picture?

According to the Economic Times, Taxspanner.com CEO Sudhir Kaushik mentioned: “If the existing PAN card does not have a QR code on it, it will not become invalid. The existing PAN card will remain valid and taxpayers can choose to get an upgraded PAN card with a QR code without any additional code. PAN Project 2.0 aims to integrate core and non-core PAN and TAN services into a unified paperless platform, in line with the government’s Digital India. This initiative will further strengthen taxation as PAN is a unified identifier for all financial transactions. Departmental network to catch tax evaders.”

How can PAN holders update or correct their details?

Yes, PAN holders can update or correct their PAN details such as name, address, date of birth, email, mobile number or other demographic information. Once the PAN 2.0 system is fully implemented, these updates will be free of charge. This feature ensures that existing PAN cards remain accurate and consistent with the user’s current information.

Ahead of the full launch of the PAN 2.0 system, PAN holders can update or correct their email, mobile number and address free of charge using the Aadhaar-based online facility. These services are available through the following official URL:

NSDL Address Update Service

UTIITSL Address Update Portal

These platforms provide a simple and convenient way to ensure that your PAN details are kept up to date while waiting for the upgraded system to be rolled out.

In summary, PAN 2.0 simplifies the process of obtaining and managing PAN cards, improving accessibility and compliance. This user-friendly upgrade is in line with India’s ‘Digital India’ vision and ensures taxpayers have seamless access to essential services.

Source: https://dinhtienhoang.edu.vn

Category: Optical Illusion